Over the past 35 years, Olam has developed into a global food and agri-business headquartered in Singapore with global market leadership positions in many of its businesses. Our success has enabled us to attract co-sponsors, strategic and long term investors, as well as world-class institutional investors, providing stability and business and financial strength to the Company.

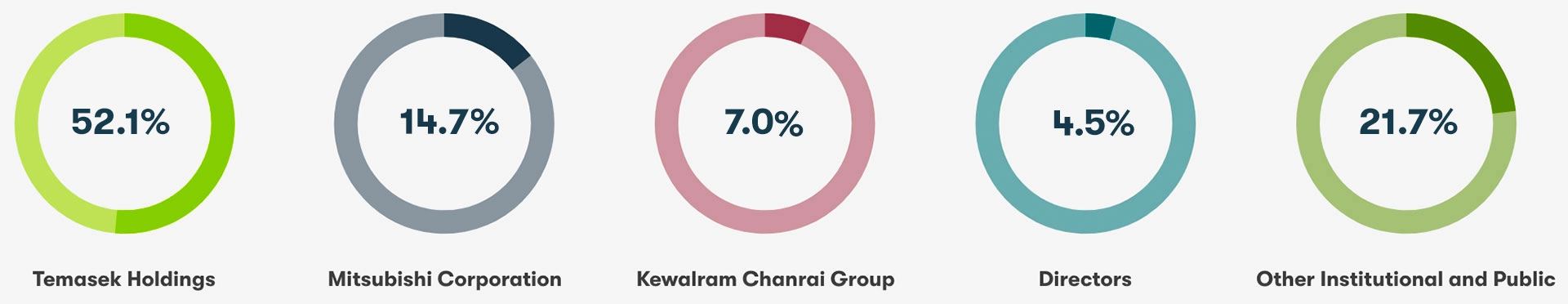

A Shareholder Base that Reflects the Long-Term Tenor of Our Strategy

Temasek Holdings, a global investment company headquartered in Singapore, became the majority shareholder of Olam after the completion of a voluntary general offer in May 2014. It currently owns 1,963,148,732 shares through Breedens Investments and Aranda Investments, representing 52.1% of the total issued share capital of Olam.

Mitsubishi Corporation (MC Group), a global integrated business enterprise headquartered in Japan, became a strategic investor and the second largest shareholder of Olam in September 2015. It holds 554,689,829 shares or 14.7% of issued capital and has two representatives on the Board. The MC Group develops and operates its businesses together with its global network of more than 1,200 subsidiaries and affiliates. Its strategic investment in Olam sets the platform for a long term strategic partnership with Olam, with several mutually beneficial potential collaboration opportunities, including a joint venture in Japan which has been set up to market specific products of Olam that can leverage its strong distribution and retail presence and Olam’s deep origination expertise in those products.

The KC Group holds 265,000,000 shares or approximately 7.0% of total issued capital. The Directors hold 4.5% of issued shares, including shares held by Co-Founder and Group CEO, Sunny George Verghese.

Other institutional and public shareholders hold approximately 21.7% of the total issued share capital.

As of 11 July 2025, Olam’s total number of issued shares is 3,770,690,285 (excluding treasury shares of 71,934,900).

Characteristics of Public Shareholder Base

As of end-December 2025, about 5.7% of total issued share capital was held by institutional investors.

| Country/Region | Distribution |

|---|---|

| North America | 43% |

| UK | 37% |

| Singapore | 7% |

| Rest of Asia | 5% |

| Europe (excluding UK) | 6% |

| Rest of World | 2% |

| Investment Style | Distribution |

|---|---|

| Value | 40% |

| Index | 36% |

| Growth | 5% |

| Hedge Funds | 4% |

| GARP | 4% |

| Others | 11% |

Source: NASDAQ